Peg ratio calculator

Firstly the daily rate of return of the concerned portfolio is collected over a substantial period of time ie. Firstly determine the current outstanding amount of the loan which is denoted by P.

What Is Peg Ratio Quora

Return on Assets Calculator.

. PE Ratio or Price to Earnings Ratio is the ratio of the current price of a companys share in relation to its earnings per share EPS. The formula for Amortized Loan can be calculated by using the following steps. Debt Ratio 15000000 20000000.

Debt service coverage ratio as its name suggests is the amount of cash a company has to servicepay its current debt obligations interest on a debt. The PE ratio of NIKE is 2846 which means that it is trading at a more expensive PE ratio than the Consumer Discretionary sector average PE ratio of about 1111. Average Collection Period Calculator.

We can calculate Debt Ratio for Anand Ltd by using the Debt Ratio Formula. The formula of some of the major efficiency ratios are. NIKE has a PEG Ratio of 235.

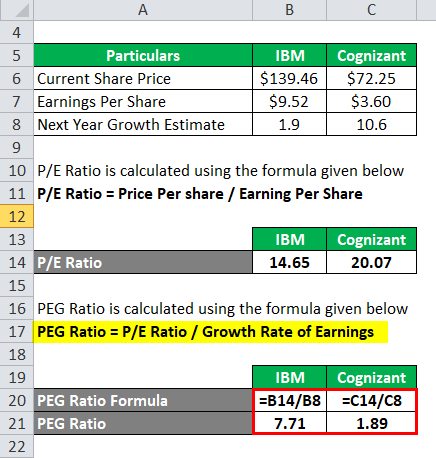

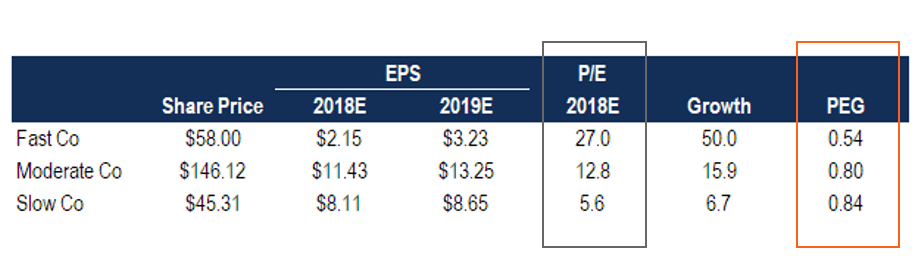

Loss Ratio 769. Firstly determine the minimum at which the producer is willing or able to sell the subject good. A PEG ratio of 10 or lower on average indicates that a stock is undervalued.

To illustrate the computation of the payout ratio. Of years which is denoted by t. PEG Complete Public Service Enterprise Group Inc.

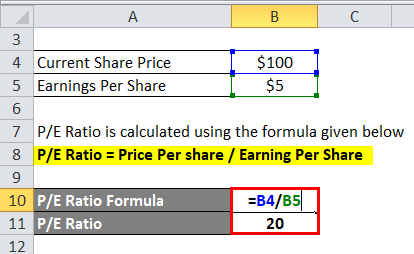

PE Ratio 1389x. We also provide you with PE Ratio Calculator with a downloadable excel template. Next determine the actual selling price of the product at which it is being traded in the market place.

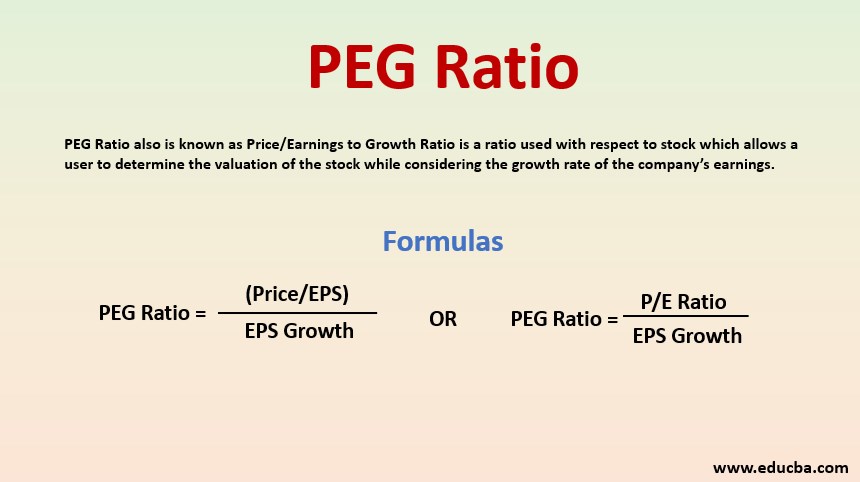

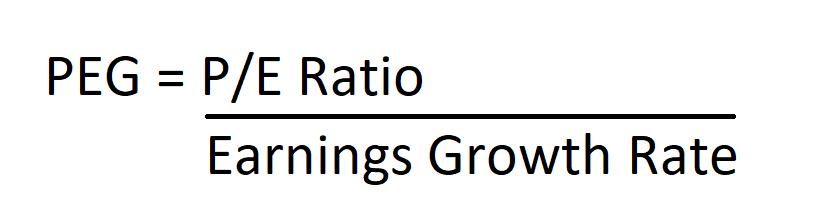

We also provide you with a Price to Book Value Calculator with a downloadable excel template. The priceearnings-to-growth ratio or the PEG ratio is a metric that helps investors value a stock by taking into account a companys market price its earnings and its future growth prospects. Let us take the example of Metlife Insurance Company or Metlife Inc.

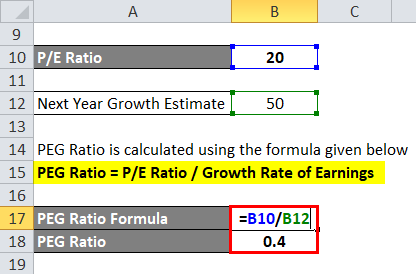

Let us take the example of Apple Inc. PE Ratio 16548 1191. But if the company is forecasting a growth rate of 50 than its PEG ratio tells a different story.

PEG Ratio PEG Ratio The PEG ratio compares the PE ratio of a company to its expected rate of growth. ETF and Mutual Fund Fee Calculator. Debt Service Coverage Ratio Formula Calculator.

Therefore the loss ratio of the insurance company was 769 for the year 2019. Capital Gains Yield CGY Calculator. Debt Ratio 075 or 75.

Debt Ratio Total Liabilities Total Assets. You may also look at the following articles to learn more Guide Retention. The sustainable growth rate SGR is the maximum rate of growth that a firm can sustain without having to increase financial leverage or look for outside financing.

PEG Ratios above 1 indicate that a company could be overvalued. Present Value and Future Value. In terms of valuation Apple Inc has a price-earnings ratio of 2721 a price-book ratio of 4567 a price-earnings-to-growth PEG ratio of 192 a EV-to-Ebitda ratio of 2066 and a price-sales ratio of 700.

This has been a guide to the Price to Earning Ratio formula. The price-to-GF Value ratio is 098 earning the stock a GF Value rank of 6. The higher the Inventory Turnover Ratio the more likely it is that a business is carrying too much inventory.

Calculator For Total Expense Ratio. What is the Expense Ratio Formula. You may also look at the following articles to learn more Examples of the Gordon Growth Model Formula.

Price to Book Value per Share Ratio. This metric can provide a much more informed view of a stock in relation to its earning potential. Loss Ratio 455 million 45 million 650 million.

Expense Ratio Formula Table of Contents Formula. In other words it allows investors an idea about a stocks. A ratio below 10 indicates that the company has less debt than.

Holding Period Return HPR Calculator. Debt Service Coverage Ratio Formula. In our earlier example investors may consider a company with a PE ratio of 30 to be overbought.

Here we discuss its uses along with practical examples. Capital Adequacy Ratio 190000000 60000000 1515151520. It will depend on various factors like the products utility uniqueness.

Stock Risk Premium Calculator. The first formula for producer surplus can be derived by using the following steps. In this case the PEG number suggests one of two things.

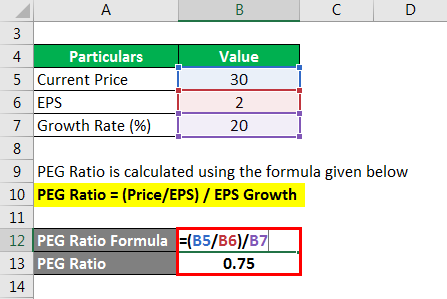

Interest Coverage Ratio EBITDA Interest Expense. PEG PE RatioGrowth Rate the company would have a PEG ratio of 06. Debt Ratio Total Debt Total Assets.

The formula for the Sharpe ratio can be computed by using the following steps. Where Should I Retire. Next determine the loan tenure in terms of no.

A PEG ratio or Priceearnings-to-growth ratio draws the relationship between a stocks PE ratio and projected earnings growth rate over a specific period. Overstocking means that cash is being tied up in inventory assets for a prolonged period. Price to Book Value Examples.

Weighted Average Cost of Capital WACC Calculator. PriceEarnings-to-Growth PEG Ratio Calculator. PEG 3050 06.

Formula to Calculate Capital Asset Pricing Model. These ratios indicate how efficiently a company is able to utilize its available assets or convert its inventories to cash. Loss Ratio Formula Example 3.

Stock news by MarketWatch. Sustainable Growth Rate - SGR. Inventory Turnover Ratio is the ratio of Cost of Goods Sold Average Inventory during the same time period.

The price-earnings ratio PE ratio is the ratio for valuing a company that measures its current share price relative to its per-share earnings. SP 500 Price to Earnings Ratio. Analysts and investors can consider earnings from different periods for the calculation of this ratio.

Here we have discussed how to calculate Mode Formula along with practical examples. Price-Earnings Ratio - PE Ratio. Price to Earnings Growth Ratio.

Return on Equity Calculator. Therefore the companys payout ratio was 30 for the year 2019. Capital Adequacy Ratio 1650 Which is a high Capital Adequacy Ratio maintained by HDFC and shows it has high stability and efficiency towards the risk-based situation.

What is a PEG Ratio. Price to Sales PS Ratio. Sum of the Parts Valuation.

We also provide a Mode calculator with a downloadable excel template. Debt-To-Equity Ratio Total Debt Total Equity. Calculate Apple Incs payout ratio for the year 2018.

Advanced Micro Devices Inc. The rate of return is calculated based on net asset value at the beginning of the period and at the end of the period. Next figure out the rate of interest to be paid on the loan and it is denoted by r.

Explanation of the Sharpe Ratio Formula. During 2018 the company booked a net income of 595 billion while it declared dividends worth 137 billion. In order to illustrate the concept of loss ratio for real-life companies.

This shows that for every 1 of assets that Company Anand Ltd has they have 075 of debt. The term expense ratio refers to the efficiency ratio that measures the expenses incurred to manage the fund as a proportion of the total investment made in the fund such as mutual fund equity fund exchange-traded fund etc. However the most commonly used variable is the earnings of a company from the last 12 months or one year.

Value Stocks Finvestable

Peg Ratio Formula How To Calculate Price Earnings To Growth

Peg Ratio Formula How To Calculate Price Earnings To Growth

Peg Ratio Formula How To Calculate Price Earnings To Growth

Peg Ratio Price Earnings To Growth Formula And Calculator

Peg Ratio Breaking Down Finance

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

Peg Ratio Price Earnings Growth Ratio What It Really Means

Peg Ratio Example Explanation With Excel Template

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube

Peg Ratio Price Earnings To Growth Formula And Calculator

What Is The Peg Ratio

Peg Ratio Definition Equation Calculation

Peg Ratio Example Explanation With Excel Template

Peg Ratio Price Earnings To Growth Formula And Calculator

Peg Ratio Definition Formula Seeking Alpha

Peg Ratio Formula How To Calculate Price Earnings To Growth