Computer rate of depreciation

Using the previous example if the computers lifespan is six years the straight-line depreciation rate would be 1 6 or 016. For example the estimate useful life of a laptop computer is about five years.

Ay 2022 23 Depreciation Rate Chart As Per Income Tax Act 1961 Income Tax Taxact Tax

The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life.

. What is a sensible depreciation rate for laptops and computers. However you are not allowed a loss if the depreciation rate is based on the average useful life of the items of property in the account. Sarahs home computer is listed property because it is not used at a regular business establishment.

The additional depreciation on the plant and machinery is restricted to Rs 80000 being 10 ie 50 of 20 of Rs 8 lakh. How do I calculate depreciation on my computer. That means while calculating taxable business income assessee can claim deduction of depreciation 40 on computers and computer software.

Now the maximum rate of depreciation is 40. For example the first-year calculation for an asset that costs 15000 with a salvage value of 1000 and a useful life of 10 years would be 15000 minus 1000 divided by 10 years equals 1400. Under this method we charge a fixed percentage of depreciation on the reducing balance of the asset.

Introduction The rate of depreciation on computers and computer software is 40. The 200 percent depreciation rate is calculated the same way as the straight-line method except that the rate is 200 percent of the straight-line rate. If you dont have it right now on your computer.

Rate of Depreciation for Computers. If the equipment in question do not. The amount of.

MobilePortable Computers including laptops and tablets effective life of 2 years from 1 July 2016 Under the depreciation formula this converts to a Diminishing Value percentage rate of 100 or Prime Cost 50. Where NBV is costs less accumulated depreciation. So that will be 1100000 depreciation provision for one year.

Learn the easiest way to do a depreciation entry in tally. Rate of depreciation shall be 40 if conditions of Rule 52 are satisfied. Applicable from the Assessment year 2004-05.

CCA Rate 100. Cost Scrap Value Useful Life. Not Book Value Scrap value Depreciation rate.

After youve calculated the straight-line depreciation you can calculate its rate by dividing one by the assets lifespan years. It is important to note that most of the classes use a half year rule which means that regardless of when you purchased the asset depreciation allowed in the first year of purchase is only half of the allowable percentage. It can also be defined as the percentage of a companys long-term investment in an asset that it recovers as a tax-deductible expense over its useful life.

The formula to calculate depreciation through the double-declining method is. Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100. So the Depreciation Rate Table A-1 A-2 tell you its depreciation value is 20 of the vehicles base rate.

Depreciation Rate as Per Income Tax Act - The depreciation rate is the percentage of an asset that is depreciated over its estimated useful life. 2 x Single-line depreciation rate x Book value at beginning of the year. We provide for depreciation each year on the above assets at a rate of 10.

Double Declining Balance Depreciation Method. 6 Machinery and plant used in weaving processing and garment sector of textile industry. In India as per the provisions of Income Tax Provisions Of Income Tax Provision for Income Tax is the estimated income tax for current year and is the amount that the entity might have to deposit to settle their tax liabilities.

It is adjusted for the expenses allowed to be deducted according. Therefore normal depreciation on plant and machinery acquired and put to use on 15122019 and computer acquired and installed on 02012020 is restricted to 50 of 15 and 40 respectively. Find the straight-line depreciation rate.

To perform depreciation calculation on computer you ought to try the calculator for depreciation. Depreciation 735000 30 1 year 220500. In order to claim depreciation 40 the equipment should fall within the expression computer.

If you buy a computer that you expect to use for five years then all you need to divide 2 into 1 to attain a depreciation rate of 02 per year. Residential buildings except hotels and boarding houses. A good and oft-used rate is 25.

For example say you have a computer that falls into the MACRS 5-year table category and youve used that computer for 4 years the table tells you that you can deduct 1152 tax from that property. Because her business use of the computer does not exceed 50 the computer is not predominantly used in. Under the depreciation formula this converts to a Diminishing Value percentage rate of 50 per annum or Prime Cost 25.

Computer software means any computer programme recorded on any disc tape perforated media or other information storage device. Diminishing balance or Written down value or Reducing balance Method. Calculate his annual depreciation expense for the year ended 2019.

Computers including computer software See note 7 below the Table 40. CCA Rate 55. Calculate the 200 percent rate in the same way as the 150 percent method except substitute 20 200 percent instead of 15.

For example a computer is depreciated. In fact for simplicity a depreciation period or rate might be determined for a complete group of assets eg. Also learn provision for depreciation and accumulated depreciation entries.

The double declining balance depreciation method is one of two common methods a business uses to account for the expense of a long-lived asset. Hence the depreciation expense for 2018 was 8500-500 15 1200. Plant and machinery might be written off over say 10 years while computer equipment might be written off over say four years.

Calculating Depreciation Using the 200 Percent Method. Computer Software tools etc.

How To Prepare Your Old Computer For Safe Disposal E Waste Recycling Old Computers Green Environment

How To Calculate Book Value 13 Steps With Pictures Wikihow Economics Lessons Book Value Books

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

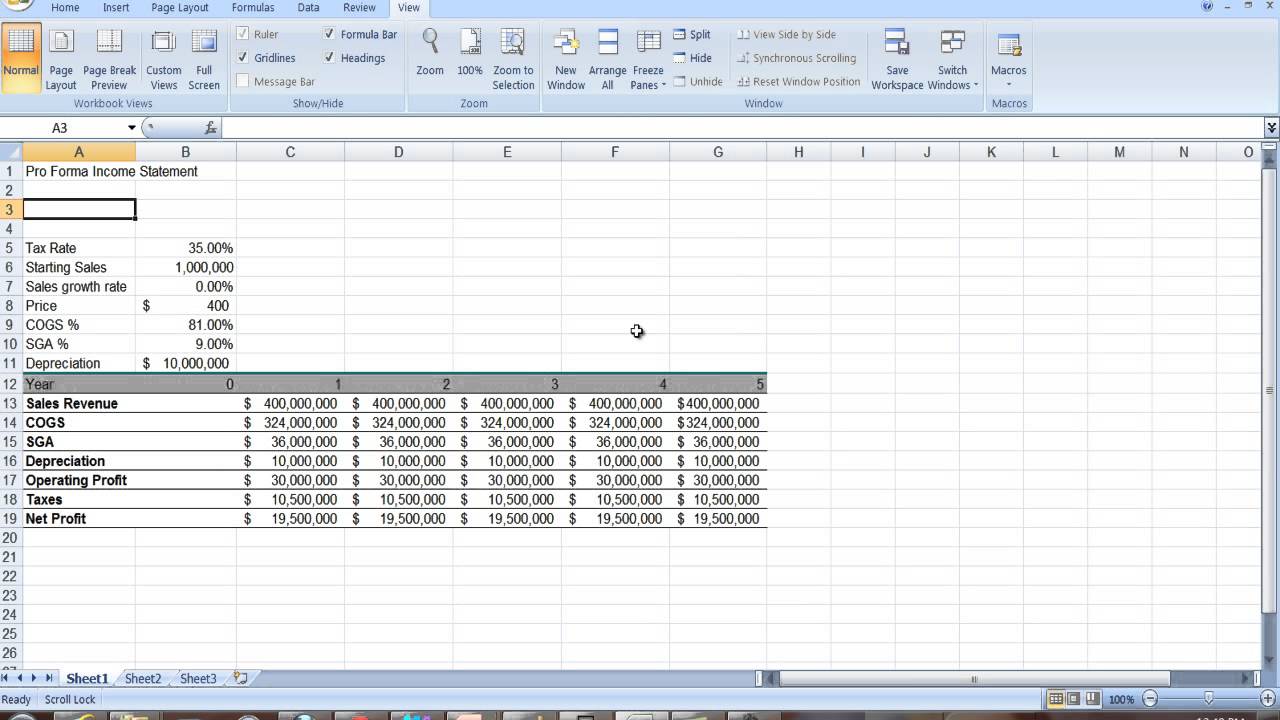

Download Projected Income Statement Excel Template Exceldatapro Statement Template Excel Templates Income Statement

Ebitda Vs Net Income Infographics Here Are The Top 4 Differences Between Net Income Vs Ebitda Net Income Learn Accounting Income

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator

Depreciation In Excel Excel Tutorials Microsoft Excel Tutorial Excel Shortcuts

How To Easily Calculate Straight Line Depreciation In Excel Exceldatapro Straight Lines Excel Line

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping Bookkeeping Templates Accounting Basics Learn Accounting

5 Logical Reasons To Buy A Used Car Visual Ly Buy Used Cars Used Car Lots Used Cars

Switches Routers Printer Server Etc Cannot Be Used Without Computer So They Form Part Of Peripherals Of The Computer A Router Switches Application Android

Taxes The Ascent By Motley Fool Estate Tax Capital Gains Tax Tax Accountant

Callable Bonds Finance Investing Financial Strategies Accounting And Finance

Declining Balance Depreciation Calculator Double Entry Bookkeeping Calculator Bookkeeping Accounting And Finance

Youtube Income Statement Profit And Loss Statement Income

Small Business Income Statement Template Unique 27 Free In E Statement Examples Templates Single Income Statement Statement Template Business Template

Methods Of Depreciation Learn Accounting Method Accounting And Finance